Our Services

Running your own business you will be acutely aware that you have to have an accurate indication of the financial position of your business. We can supply this for you.

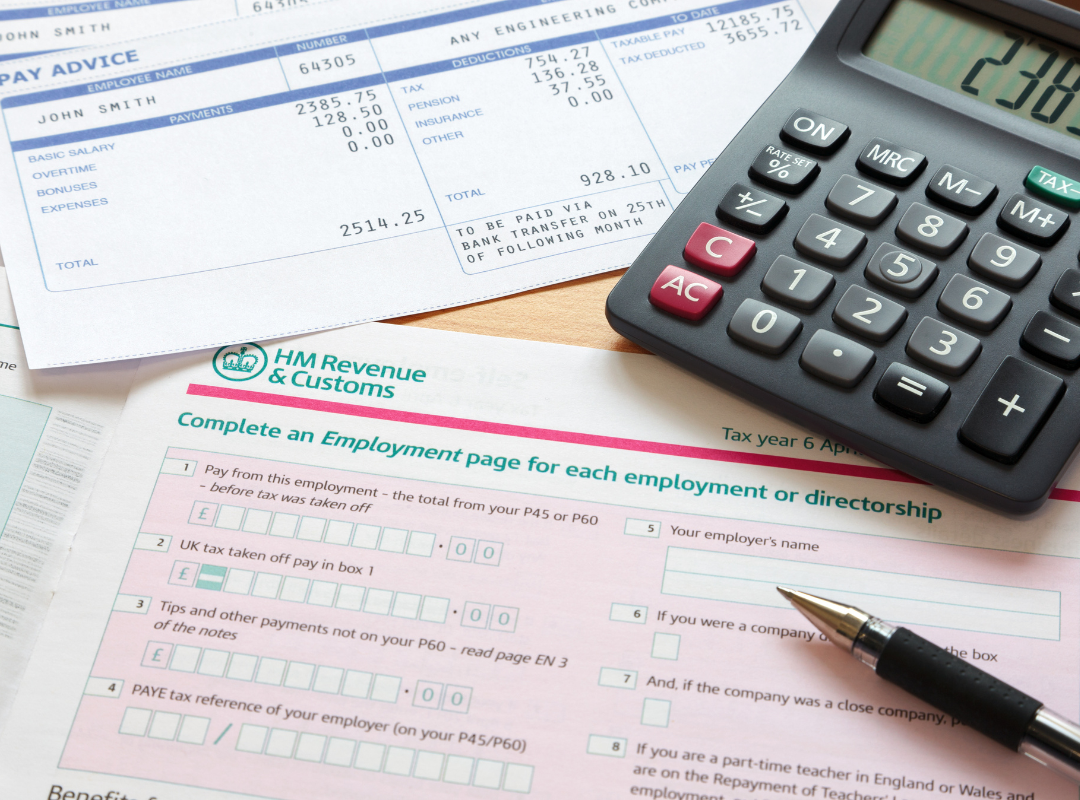

Tax Returns

VAT Returns

Payroll Services

tax returns and self assessment

Filling in a self-assessment form can be a real headache

Our team can help you by completing this task for you and offer some helpful insights to the whole process. Did you know for instance, you can claim the cost of our accountant’s fees – for preparing your tax return, – as a tax deduction.

You could try to complete your tax return by using one of the many online services that are springing up. However an article in the

Guardian had someone saying – “We hear horror stories of completely unqualified people setting up websites where the charges are highly misleading. They have a low upfront cost, but then lots of add-ons.” – Why take the risk?

As part of our commitment to our customers we offer a free initial face to face consultation. Our relaxed and friendly staff will assess your requirements and provide honest expert advice to you through our dedicated personal service. Call us now for further details on the services available through Bell and Cawthorne.

We understand that trusting a new accountant to deal with your finances can be daunting. Find out more about us here>

payroll services

Are you thinking about outsourcing your payroll?

It’s a big decision to make and some may see it as losing some control and a waste of money. That couldn’t be further from the truth.

Payroll outsourcing is an important time saving administration process that every company should consider. Whether you are a small or larger organisation, Bell and Cawthorne can tailor our payroll service to suit your individual requirements and provide a well-managed payroll solution.

From our base in Stapleford, Nottingham we welcome work from sole traders and small limited companies and SME’s alike and we currently run the weekly/monthly payroll for a wide selection of business types here in the East Midlands.

If you trust us with the running of your payroll we will do our utmost best to ensure:

- All your staff are paid accurately, on time, every time

- You can forget about errors being made an disgruntled employees

- You are fully up to date with all current legislation pertaining to your payroll

We understand that trusting a new accountant to deal with your finances can be daunting. Find out more about us here>

vat returns

An efficient, cost-effective VAT return service

The ever changing regulations surrounding VAT, along with the growing demands of HMRC mean that compliance can often become a difficult administrative process that you dread. Bell and Cawthorne can help to ensure that your company complies with all the regulations and that your VAT returns run smoothly and, perhaps most importantly, are made on time.

To help you manage this complex task, we can provide you with an efficient, cost-effective VAT return service, which includes:

- Completing VAT returns

- Help with initial VAT registration

- Advice on VAT planning and administration

- VAT reconciliation

- Negotiating with HMRC in disputes

We understand that trusting a new accountant to deal with your finances can be daunting. Find out more about us here>

accounts

We can help with your basic day to day accounts

Our accounts services include entry of purchase invoices, cash receipts and sales invoices. We can reconcile your bank and credit card statements and complete your Tax Returns and manage your Payroll.

We understand that trusting a new accountant to deal with your finances can be daunting. Find out more about us here>

Our full list of accounting services includes:

- Accounts to Trial Balance

- Cash Flow Forecasts Computerised Accountancy Systems

- Draft Final Accounts for Limited Companies and Partnerships

- General Ledger

- Maintaining Fixed Asset Register

- Month End Processing

- Payroll, employee records + submission of year end

- Preparation of Final Accounts for Sole Traders

- Self-Assessment Tax Returns

- VAT Returns

- Year End Preparation

- Financial Accounts